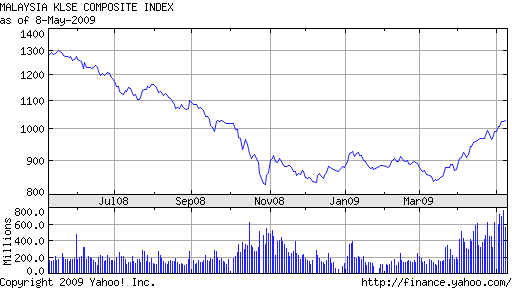

Do you invest in KLCI? Are you investing by buying unit trust or stock directly? I have been investing on both of them. Each of them has its own advantages and disadvantages. KLCI hit bottom at 801.27 on 28 October 2008. And it is 1026.78 on 8 May 2009. Stock and unit trust, which one will perform better?

KLCI result for last 1 year

The benchmark starts from 28 October 2008 until 8 May 2009. Public Mutual Unit Trust has lot of funds. I did some research on them which invest in KLCI. Public Aggressive Growth Fund (PAGF) is the best performer with 38.51% return and Public Index Fund (PIF) is the worst performer with 16.67% return. All the other Public Mutual Funds which invest in KLCI fall between 16.67% and 38.51% returns. This mean that you will get at least 16.67% if you invest in unit trust.

Let’s see the return if we invest into stocks directly.

PBBANK 1295 (PUBLIC BANK BHD) from banking sector was at RM8.20 on 28 October 2008 and RM8.60 on 8 May 2009. It gave RM0.25 dividend during this period. Therefore, total return for PBBANK is 7.92%.

BURSA 1818 (BURSA MALAYSIA BHD) from capital/financial/insurance sector was at RM4.90 on 28 October 2008 and RM7.25 on 8 May 2009. It gave RM0.078 dividend during this period. Therefore, total return for BURSA is 49.55%.

GAMUDA 5398 (GAMUDA BHD) from construction sector was at RM1.40 on 28 October 2008 and RM2.52 on 8 May 2009. It gave RM0.04 dividend during this period. Therefore, total return for GAMUDA is 82.86%.

BAT 4162 (BRITISH AMERICAN TOBACCO BHD) from consumer sector was at RM42.00 on 28 October 2008 and RM43.00 on 8 May 2009. It gave RM0.76 dividend during this period. Therefore, total return for BAT is 4.19%.

GENTING 3182 (GENTING BHD) from gaming sector was at RM3.94 on 28 October 2008 and RM4.98 on 8 May 2009. It gave RM0.04 dividend during this period. Therefore, total return for GENTING is 27.41%.

PETDAG 5681 (PETRONAS DAGANGAN BHD) from oil & gas sector was at RM6.70 on 28 October 2008 and RM7.85 on 8 May 2009. No dividend during this period. Therefore, total return for PETDAG is 17.16%.

IOICORP 1961 (IOI CORPORATION BHD) from plantation sector was at RM2.19 on 28 October 2008 and RM4.36 on 8 May 2009. It gave RM0.03 dividend during this period. Therefore, total return for IOICORP is 100.46%.

There is lot of stocks to invest. Above are just some of them that have positive return. Some of them are still in red colour ~ negative return.

After seeing all of these… Which one is better? Stock or unit trust? For beginner investor, better put more money at unit trust because the fund manager will look after it for you. For those who don’t want to study stock one by one also advisable to invest in unit trust. The risk is higher by investing directly in stocks but the return is better too.

Choose wisely… 🙂